Podcast: Play in new window | Download | Embed

Subscribe: RSS

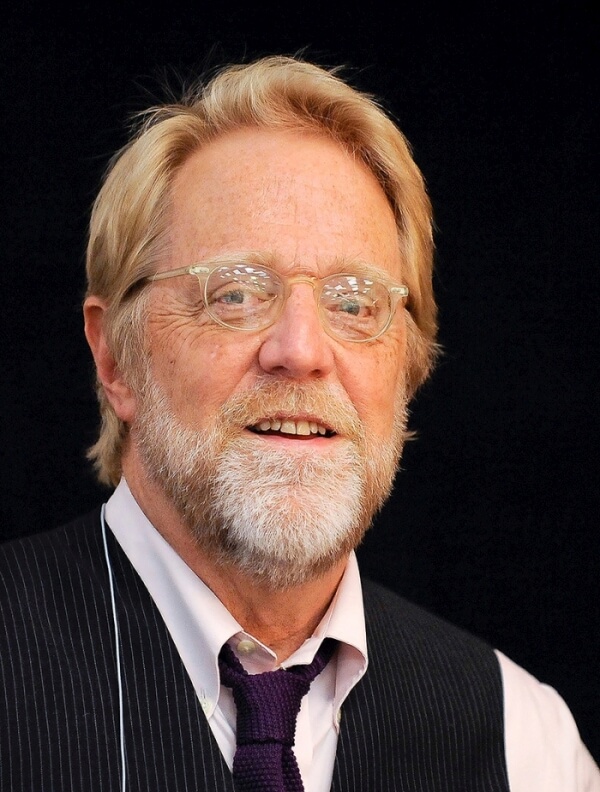

Jonathan Taplin is the Director Emeritus of the USC Annenberg Innovation Lab, and a former tour manager for Bob Dylan and The Band, as well as a film producer for Martin Scorsese.

Jonathan Taplin is the Director Emeritus of the USC Annenberg Innovation Lab, and a former tour manager for Bob Dylan and The Band, as well as a film producer for Martin Scorsese.

If that is not enough to make him a worthy guest of Singularity.FM then let me add that Jonathan is a visionary entrepreneur who started the very first streaming VOD startup called Intertainer way back in 1996.

Finally, Taplin is the author of a timely book titled Move Fast and Break Things: How Facebook, Google and Amazon Cornernerd Culture and Undermined Democracy. In my view, Move Fast and Break Things is a must-read, and we all should not only discuss but also take political action on the issues described by Jonathan. [At least to the extent that we want to have a sustainable and working democracy.]

During our 75 min conversation with Jonathan Taplin we cover a variety of interesting topics such as: becoming Bob Dylan’s music producer; becoming Martin Scorsese’s film producer; his biggest dream and biggest fear; the thesis of his book Move Fast and Break Things; whether Google, Amazon, and Facebook are monopolies; culture and the quality YouTube content; great amateur movies like Envoy and True Skin that were either worthy or already bought to be turned into feature films; Facebook and democracy; copyright, piracy, privacy, DRM and SOPA…

As always you can listen to or download the audio file above or scroll down and watch the video interview in full. To show your support you can write a review on iTunes, make a direct donation or become a patron on Patreon.

Who is Jonathan Taplin?

Jonathan Taplin is Director Emeritus of the Annenberg Innovation Lab at the University of Southern California. He was a Professor at the USC Annenberg School from 2003-2016. Taplin’s areas of specialization are in international communication management and the field of digital media entertainment. Taplin began his entertainment career in 1969 as Tour Manager for Bob Dylan and The Band. In 1973 he produced Martin Scorsese’s first feature film, Mean Streets, which was selected for the Cannes Film Festival. Between 1974 and 1996, Taplin produced 26 hours of television documentaries (including The Prize and Cadillac Desert for PBS) and 12 feature films including The Last Waltz, Until The End of the World, Under Fire and To Die For. His films were nominated for Oscar and Golden Globe awards and chosen for The Cannes Film Festival five times.

Jonathan Taplin is Director Emeritus of the Annenberg Innovation Lab at the University of Southern California. He was a Professor at the USC Annenberg School from 2003-2016. Taplin’s areas of specialization are in international communication management and the field of digital media entertainment. Taplin began his entertainment career in 1969 as Tour Manager for Bob Dylan and The Band. In 1973 he produced Martin Scorsese’s first feature film, Mean Streets, which was selected for the Cannes Film Festival. Between 1974 and 1996, Taplin produced 26 hours of television documentaries (including The Prize and Cadillac Desert for PBS) and 12 feature films including The Last Waltz, Until The End of the World, Under Fire and To Die For. His films were nominated for Oscar and Golden Globe awards and chosen for The Cannes Film Festival five times.

In 1984 Taplin acted as the investment advisor to the Bass Brothers in their successful attempt to save Walt Disney Studios from a corporate raid. This experience brought him to Merrill Lynch, where he served as vice president of media mergers and acquisitions. In this role, he helped re-engineer the media landscape on transactions such as the leveraged buyout of Viacom. Taplin was a founder of Intertainer and has served as its Chairman and CEO since June 1996. Intertainer was the pioneer video-on-demand company for both cable and broadband Internet markets. Taplin holds two patents for video on demand technologies. Professor Taplin has provided consulting services on Broadband technology to the President of Portugal and the Parliament of the Spanish state of Catalonia and the Government of Singapore.

Mr. Taplin graduated from Princeton University. He is a member of the Academy Of Motion Picture Arts and Sciences and sits on the International Advisory Board of the Singapore Media Authority and is a fellow at the Center for Public Diplomacy. Mr. Taplin was appointed by Governor Arnold Schwarzenegger to the California Broadband Task Force in January of 2007. He was named one of the 50 most social media savvy professors in America by Online College and one of the 100 American Digerati by Deloitte’s Edge Institute.

The economic effects of emerging disruptive technologies like Artificial Intelligence (AI) pose an area of deep thought and concern. AI represents a “winner-take-all” technology. Companies that invest in it can dominate their competitors, exacerbating a trend of wealth inequality that is already a growing concern. This change is playing out against a landscape of other shifting economic trends: tech companies increasingly being built to flip for quick profit, distributed technologies like the blockchain facilitating new types of corporate entities like the Distributed Autonomous Organization (DAO), and labor displacement raising calls for a “basic minimum income”.

The economic effects of emerging disruptive technologies like Artificial Intelligence (AI) pose an area of deep thought and concern. AI represents a “winner-take-all” technology. Companies that invest in it can dominate their competitors, exacerbating a trend of wealth inequality that is already a growing concern. This change is playing out against a landscape of other shifting economic trends: tech companies increasingly being built to flip for quick profit, distributed technologies like the blockchain facilitating new types of corporate entities like the Distributed Autonomous Organization (DAO), and labor displacement raising calls for a “basic minimum income”. David Rostcheck

David Rostcheck

hilarious clip from Burnistoun

hilarious clip from Burnistoun